You will love MyP2P if you are a true football fan. This is an online streaming site that allows you to watch all football matches for free. A lot of people enjoy watching football matches on this site. For sports fans who want to watch sport online for free, MyP2P is one of the best options for them.

There are many other sports you can watch here besides football, such as boxing, soccer, tennis, UFC, and many others. You can watch it all for free. However, you need to remember that this site and its streams are illegal, so we recommend you to make use of legitimate services instead.

Despite the fact that some sites ask for a subscription, many sports fans ignore those sites, but MyP2P is a lifesaver for all sports fans. This is a place where you can enjoy sports at no cost, without having to subscribe to anything. You can read more about Myp2P in the following article if you wish to learn more about it. The following article contains all the answers related to Myp2P.

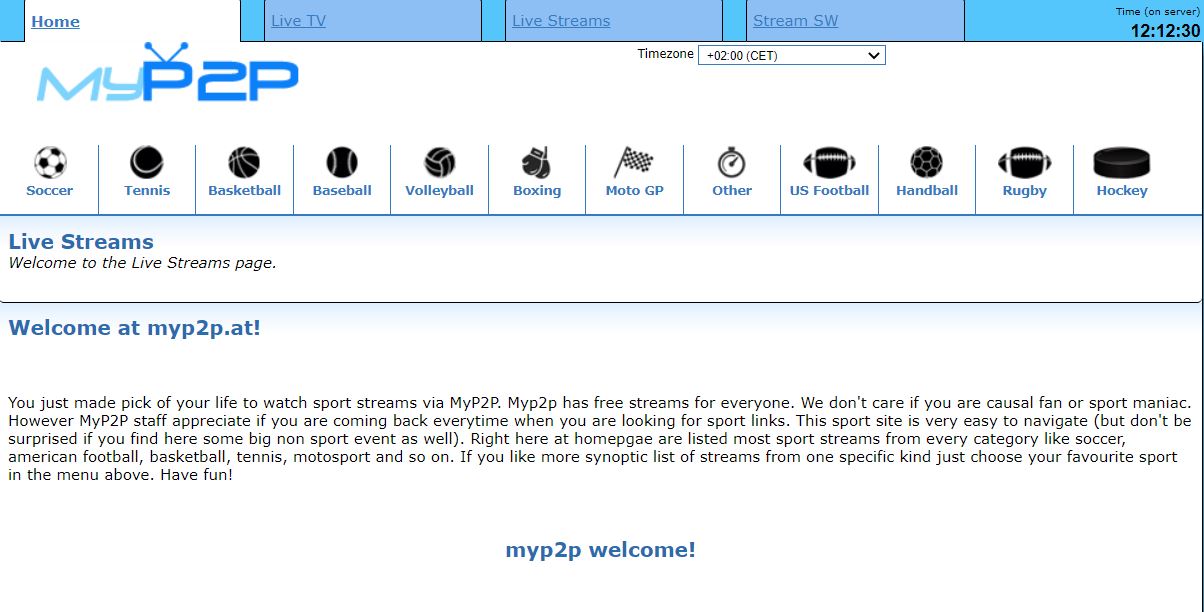

What is MyP2P?

I would like to introduce you to a sports streaming site called MyP2P, where you can watch sports online for free, without having to spend any money. You can find here those matches that are not scheduled to be broadcast on any of the television channels.

The best links are listed below:

Whenever you search for free football streaming on a search engine, MyP2P is likely to come up on the first page. It is true that the Myp2p site is occasionally plagued by poor connectivity and legal issues, but besides that, it is one of the most reliable platforms.

Among the sports content Myp2p offers are Myp2p tennis, Myp2p basketball, Myp2p football, and Myp2p handball. They all drive traffic to the site. Unlike other free sport streaming services, Myp2p broadcasts their content to their viewers in a different way via peer-to-peer networks.

Myp2p live streaming

On this website, you will find the majority of free sports streaming websites and football prediction platforms. It is because of this that the Myp2p is a complicated and controversial platform. Nevertheless, the unique quality of MyP2P resides in the fact that this site uses peer-to-peer (P2P) technology.

Using Myp2p, you will also be able to communicate with others while watching the matches. The idea is to create a network between individuals by making use of computers so that they can share information directly with each other. There is no need for a central server.

The MyP2P network enables sports fans to share live streams directly from their devices to the network. It is one of the most unique features of the network.

Peer-to-Peer broadcasting

Myp2p is unique compared to other streaming websites because it follows a peer-to-peer networking system and broadcasts UFC Live events, football matches, and boxing fights for their users.

Nevertheless, this technology has become outdated nowadays. Developed for the purpose of providing a platform for downloading files from email, this system has seen a lot of success in the early years of the internet’s world.

Therefore, when we discuss MyP2P, we are talking about a method of data transmission. Their users are able to share content with other users using this feature. It is important to remember that a user is both a transmitter and a receiver of data.

Myp2p Live Sports

Myp2p is mainly known for its live football streaming website. However, this site covers an extensive range of sporting events, including soccer and baseball. It is a system that allows all streaming services to be provided to sports fans around the globe without needing any high-performance servers.

The sharing feature can be used for any event where sports lovers are looking for free tickets. Here you’ll be able to watch Myp2p tennis streaming, Myp2p boxing streaming, and Myp2p Live UFC streaming for free. The website has been designed to be extremely user-friendly.

Myp2p Football

We can say with confidence that this is the most popular football page on the planet for football fans. Every day, thousands of people come here to watch football matches online for free. Moreover, Myp2p has built the football category on the top of all the other categories.

With this website, you will be able to watch all of the biggest football matches, as well as the latest football news and the best football awards. You can also discuss every weekend expert correct score prediction tips here. With a few words, I can tell you that football streaming is a priority of Myp2p, and that you can watch every football match here for free and without interruption at any time.

Myp2p Alternatives

MamaHD

This is the best alternative to Myp2P and this site is also free to use compared to MyP2P. On this site you can watch unlimited live sports events. You can also watch video highlights and view schedules for free without any limitations. Mama HD offers almost all the major sports channels, so you can watch all the sports categories like Hockey, Football, Soccer, Boxing, MotoGP, Cricket, etc.

There is a channel to stream every category. It is possible to choose which sport you want to watch from the list there. In addition to this, you can also watch the latest news and events on this website. In comparison with other streaming services, this website has this advantage.

In addition to streaming, Mama HD offers a chat feature. With this feature, you can communicate with other sports fans all over the world and discuss the games you are watching. With this feature, you can enjoy its services from anywhere in the world.

Feed2All

The platform Feed2All is a live stream of football and many other sports and it is considered as the next alternative to MyP2P. Through this platform sports fans would be able to watch their favorite sports channels for free. You can stream many live matches of various sports, including football and other sports.

Since Feed2all collaborates with many leading sports live channels, it is able to offer uninterrupted streaming of most of the sports. You can find a list of all the football matches that are currently taking place between multiple teams on the main page.

By simply clicking on the link provided, you will be able to see all the options that are available to watch live streaming. We offer you the chance to watch all your favorite sports matches for free on our website.

goATDee

As well as streaming sports, this site offers news and information. Although this is not a great sports streaming platform, it is the best alternative to MyP2P if you’re looking for one. A free sports news and video website is also available here. This site is very popular in the United States. Therefore, you can also try this site if you want to watch your favorite sporting events and matches.

There may be some people outside the United States who do not find it attractive or suitable for their needs. But for the most part, this website is very simple and easy to use. On this site, you can stream only sports channels and ongoing live matches.

Streamcomando

Our website offers free access to a variety of sports channels and is ad-supported. It provides its visitors with an array of options to watch the leading sports channels from across the globe. Streamcomando gathers all the live sports TV links in a single centralized platform and makes them available to you immediately. It also allows its visitors to watch their favorite sports on their favorite sports channel as well.

It is possible to enjoy a wide range of sports like hockey, football, basketball, tennis, golf, etc. at the best quality right in the comfort of your home. There are more options on Streamcomando for soccer matches and football matches. Streamcomando offers a wide selection of matches from the most popular clubs and leagues.

VipBoxTV

This is the fastest-growing sports live streaming website in the world. Specially designed for sports fans who want to stream live sports from all over the world from the comfort of their home. Through this website, you are able to get information about everything from hockey tournaments taking place in Russia to football matches taking place in Brazil.

On this site, you can watch new games almost every day and there are also new games being added all the time. This site offers lots of new features, tools, and services without any limits. You can choose from more than 33 sports categories to enjoy live streams on VIPBoxTV. You can watch your favorite games from all over the world without any limitations whatsoever.

I think that the best feature of this website is its new Admin Tools section. Here you can enjoy lots of new features, such as you can adjust video quality, you can watch two channels at the same time, and many more. There is also a chat section where you can chat with other users.

FirstRow Sports

The site is dedicated specially to football and soccer lovers and also deals with a variety of other sports as well. You can get free access to all kinds of sports streams on this site, which provide all kinds of streams of all the leading sports channels. All you need is a supported web browser with Adobe Flash Player. After that, you will have the ability to watch free streaming without any interruptions.

You can download it on your smartphone and use it on the go. If you wish to enjoy smooth streaming at any time, you need only use the Skyfire web browser.

RedstreamSport

The following is an independent streaming source. RedstreamSport takes the streaming links from the other major streaming sites and displays them here. You can watch live sports TV for free at RedstreamSport. You will find in this section a list of the streaming content that has been submitted both by its regular users and by its webmasters.

You can find many streams on RedstreamSport for every event that you would like to watch, and you can choose the one you prefer out of all of them. You can also shuffle between the multiple available streams instantly. A free-to-use website, RedstreamSport provides its users with the best and most uninterrupted streaming experience available on the internet today.

The short version is that I can say this is a straightforward website and I find it to be a good alternative to Myp2P. In addition, it provides a language translation feature, but this site has some annoying advertisements.

The above information is all you need to know about MyP2P and the alternative which you can use when you want to watch your favorite sport.