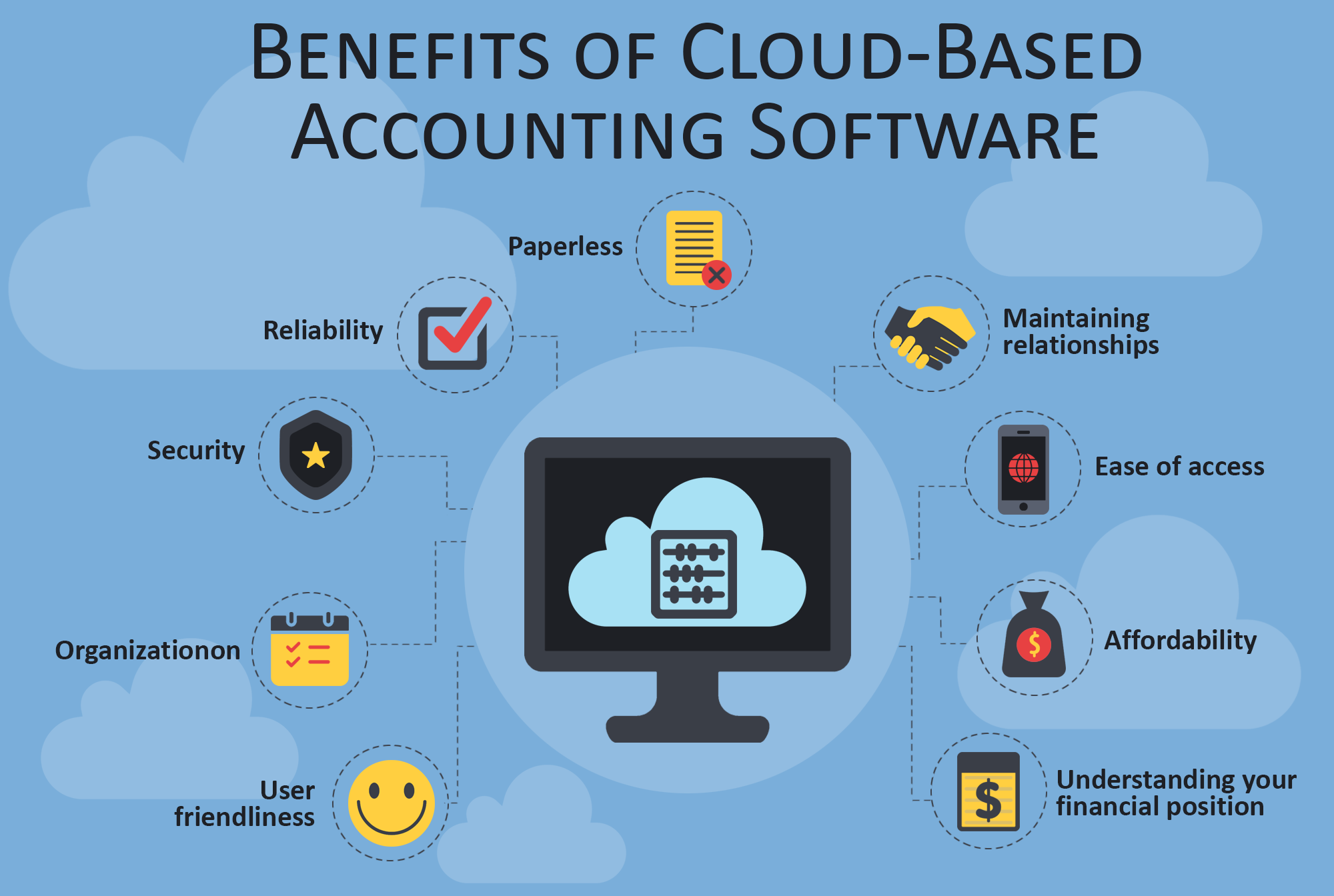

The latest versions of cloud-based accounting software are always available. With this feature, you never have to worry about expensive or time-consuming software updates, and you don’t need to worry about security fixes, either. These issues are handled automatically by the software provider. Here’s what you can expect from cloud-based accounting software. Ultimately, it all comes down to which platform is right for you and your business. Read on for more information about the benefits and drawbacks of cloud-based accounting software and common it help desk issues.

Vyapar

Vyapar is a cloud-based accounting software, which means that it will allow you to link with multiple devices at the same time to edit or view the data. This ease of use allows you to manage your business from anywhere. You can also set up permission levels to control who can access your company’s financial information. The software will also record actions that are performed by other users who is having access to the data and due to limited access feature you can be sure that no one can view sensitive financial information without your permission.

If you do encounter technical difficulties, Vyapar provides a number of resources to help you. Their help center has extensive articles and videos about the software’s features, as well as a community that has members that can provide help and answer questions. You can also post questions to this community, if you need it. However, the company recently removed the option of chatting with a representative directly within the software.

Vyapar relies heavily on automated data transfer and pre-population methods to reduce the amount of repetitive data entry. Additionally, the accounting app is also designed to present data elegantly. It bills itself as “the most beautiful accounting software on the market,” and its user interface is far from the CPA CD-ROM software of the 1990s. Its beauty lies in how it works, rather than what it looks like.

QuickBooks Online

You’ve probably heard of QuickBooks Online, but do you know exactly what it is? Basically, it’s cloud-based accounting software, available in the cloud. It’s the perfect solution for small businesses that need to track expenses without spending a ton of money on software. Besides, it has a lot of benefits, including unlimited customer support, automatic data backup and recovery, and easier access to updates. The best part is, you can switch between hosted and desktop versions seamlessly.

Also Read: How to Grow Your Instagram Following?

QuickBooks Online has several advantages over desktop-based accounting software. It’s compatible with all major browsers and devices, allowing multiple users to access your data on the go. You can use it from any device with an Internet connection. You’ll also find that it’s affordable to use, with affordable monthly payments. Additionally, it’s extremely secure. It backs up all your data on intuit servers, so you’ll never have to worry about losing it. You can also take advantage of automatic updates and user permissions, as well as attach photos to transactions.

There are several causes of QuickBooks errors. One of the most common causes is a broken network connection. Sometimes, QuickBooks will experience an error when accessing a company file. Other errors may include an incorrect or missing account mapping or a faulty SSL connection. You can also run into the QuickBooks Error Code 6000 82 if the file that’s storing your company data is damaged. The software might also be outdated if you don’t have the right permissions or your machine doesn’t have the correct settings to install it.

Xer

Xer is cloud-based accounting software that lets you handle your financial statements from any computer. The software is very easy to use and has all the features you’d expect from a top-notch accounting package. You’ll also enjoy a variety of other features that make accounting much easier. These features include auto-updates, automated payment of vendors, and even the ability to send invoices to recurring customers.

Vyapar is a cloud-based accounting software that can be accessed from any computer or mobile device. You can view and update transactions anywhere, anytime. Its security features are excellent. Vyapar offers a number of options to secure your data. This includes a user-friendly interface, automatic bank feeds, and multiple layers of security. It also offers online support and training. You can even customize Vyapar according to your business.

One of the biggest advantages of using cloud-based accounting software is that you don’t have to install the software on your computer. Instead, you simply login using a web browser or mobile app. This also means that you’re saving money on IT staff. Plus, you can easily manage employee access. There’s no need for an IT team to administer cloud-based accounting software. This makes it easy to manage and maintain, and it can save you money.